小间距P1.2全彩LED显示屏

小间距P1.4全彩LED显示屏

小间距P1.5全彩LED显示屏

小间距P1.6全彩LED显示屏

小间距P1.8全彩LED显示屏

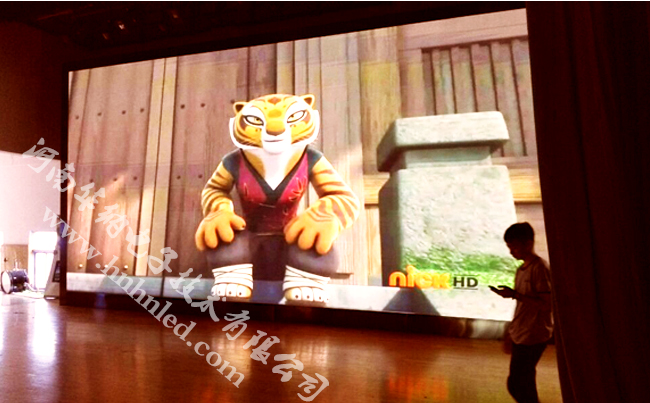

室内P2全彩LED电子显示屏

室内P2.5全彩LED显示屏

室内P3全彩Led电子显示屏

室内P4全彩LED电子显示屏

室内p5全彩led电子显示屏

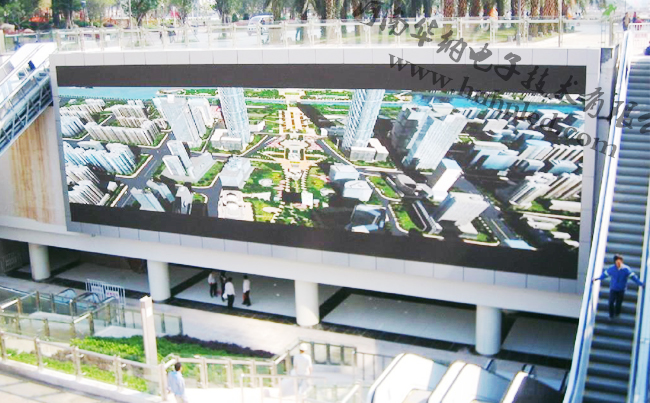

户外P4全彩LED电子显示屏

户外P5全彩LED电子显示屏

户外P6全彩LED电子显示屏

P8户外全彩LED电子显示屏

户外P10全彩LED电子显示屏

室内P6全彩led电子显示屏

室内P7.62表贴全彩LED电子显示屏

P16户外全彩LED电子显示屏

室内Ф3.75单色LED显示屏

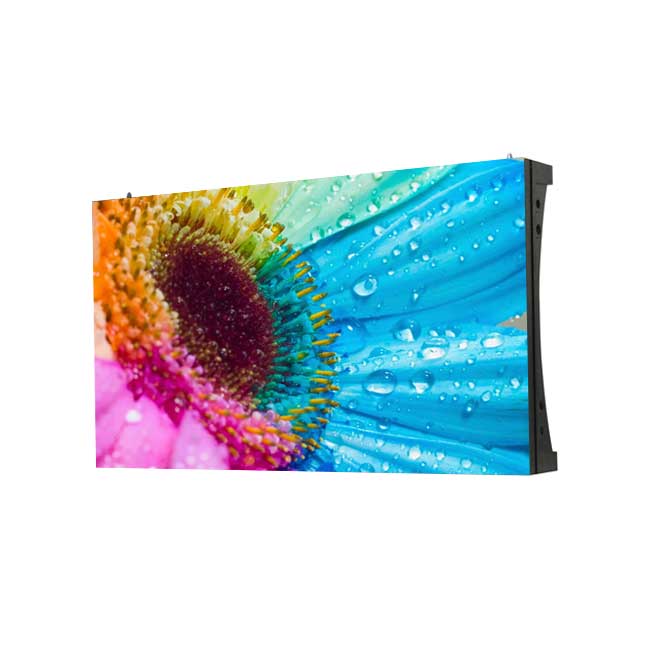

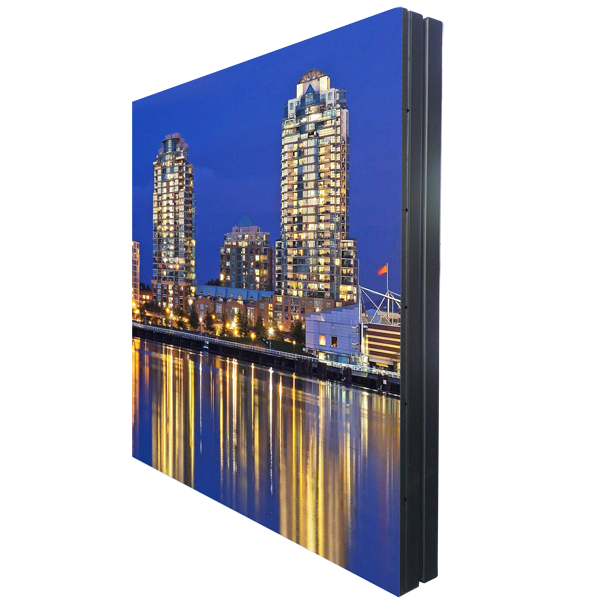

LG 42寸\46寸\50寸\55寸LCD液晶拼接屏

地址:郑州金水区林科路与政七街东20米 猫咪视频app技术有限公司 3楼东户306室

24小时咨询热线:15038190333

24小时咨询热线:13939018676

邮箱:

hndzled@163.com

电话:0371-60970198

电话:0371-67998933